I am in favour of the Welfare State, in principle, but that just begs the question. Even the Iain Dunce Duncan Smiths and Esther McVeys of this world go that far, at least in public utterances. The devil really is in the detail here.

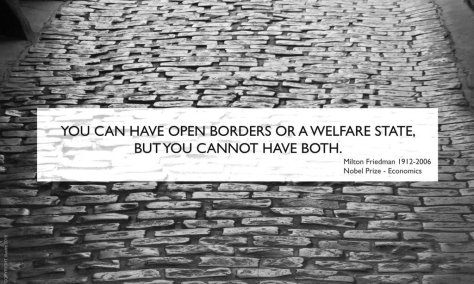

The famous economist, Milton Friedman, once said that you can have open borders, and you can have a welfare state, but you cannot have both. That it is even necessary to posit that shows how far the more socialist-minded people in the UK (and elsewhere in Northern Europe) have travelled from reality. Many “refugees welcome” dimwits actually believe that an almost endless number of “refugees” or others can enter the UK without affecting State benefits and services (as well as road and rail congestion etc). This seems to be based on the idea that the immigrants will work, pay taxes, in short become normal citizens or quasi-citizens. Angela Merkel thought the same, only to find that most “refugees” were

- incapable of any but the most basic work (such as fruit-picking) because of their linguistic and/or educational levels;

- unwilling, in many cases, to work, in a situation where the State provides free accommodation, free utilities, free transport for some, free food for some, as well as pocket money on quite a generous level.

The UK does not provide social security (or, in our new Americanized speech, “welfare”) benefits on the generous scale offered by Germany or Scandinavia etc, but the fundamentals are similar.

A personal story: when I was much much younger, in my early twenties, I became acquainted, via a lady I then knew, with a friend of hers (more accurately a woman who had attached herself to her like a limpet). Now this other woman was not British in any sense except that she had married a New Zealander who had (presumably because taken there from the UK as a child) a British passport. The woman was in fact a Jewess from Moscow, who had somehow got to know the New Zealander while he was on a holiday trip to the Soviet Union. We need not examine motives and reasons, but that couple married and went to live in New Zealand. They had two children. After about four or five years, the woman left her husband, left New Zealand and flew to the UK.

When I met the woman in question, I believe that she had been in the UK for a couple of years. She washed-up in Downham, an obscure suburb in South-East London, where the local council provided her with a council flat. I have no exact idea of what other benefits she was granted, but they would have included child benefit and some form of income support. She never had to work, though at first she did a couple of evenings a week teaching Russian at some place or other which I forget (possibly Morley College in Westminster Bridge Road, or the City Literary Institute in Drury Lane, both of which adult education centres I myself frequented at the time).

Scroll on a few years. This “Russian” Jewish woman, with no real connection to the UK at all had been given a quite decent house with gardens in Grove Park, a better part of the same borough. She had been impelled to move, apparently, by a visit from her father, a nuclear scientist (which sounds impressive, but the Soviet Union had legions of them) who had told her that she would have a better flat were she to return to Moscow! Of course, there she would have had to work…anyway, I visited the new house once (out of duty rather than choice) and so saw it, despite being not much liked by the woman. The woman had been diagnosed with a kidney complaint (though I never saw her looking unwell) and so no doubt managed to claim some form of incapacity or disability benefit; and had also acquired a car (almost certainly also funded by the State). In addition to all of that, the woman and her children also had all the usual UK benefits of free education and health. I do not think that she bothered to do much work after that, maybe a little part-time teaching or occasional low-level interpreting.

Now it might be said, perhaps especially by people more naturally drawn to socialism than capitalism, that she was entitled to these things because lawfully resident in the UK. Perhaps, but look at it from the wider point of view: she had never contributed anything to the UK, just taken. The small part-time jobs here and there can be discounted as having been de minimis. She leeched off the UK’s people since about 1979 and, the last I heard (a couple of years ago), that situation remained unchanged, probably to this day. In fact, she would now be “entitled” to a State pension and Pension Credit. Call it 40 years of being a millstone round the neck of the British Welfare State.

Now multiply the above by millions, the millions of often completely useless people from the backward hordes imported into the UK for decades. For example, it is reported that only 20% of the huge numbers of Somalis in the UK (how? why?) are employed at all.

I repeat, I do favour a decent Welfare State, but it can only exist if

a. the economy can support it;

b. it is not swamped.

The above two conditions really come down to the same thing now, or very nearly so.

For me, the answer to the work and income challenges of robotics, computerization, Internet shopping, AI etc is the Basic Income concept, but Basic Income, like the existing Welfare State, will decline and may fail unless it is restricted to those who are at the very least, genuine citizens.