Afternoon music

Talking point

He has a point, nicht wahr?

Tweets seen

…and there were relatively few Pakistanis even in the UK at that time.

One cannot help but think that California, especially the southern and central coastal parts, is a massive catastrophe waiting to happen, as portrayed in so many of the Hollywood films. Earthquake, fire, tsunami, race war, alien invasion etc. You name it.

More tweets seen

See also:

More tweets

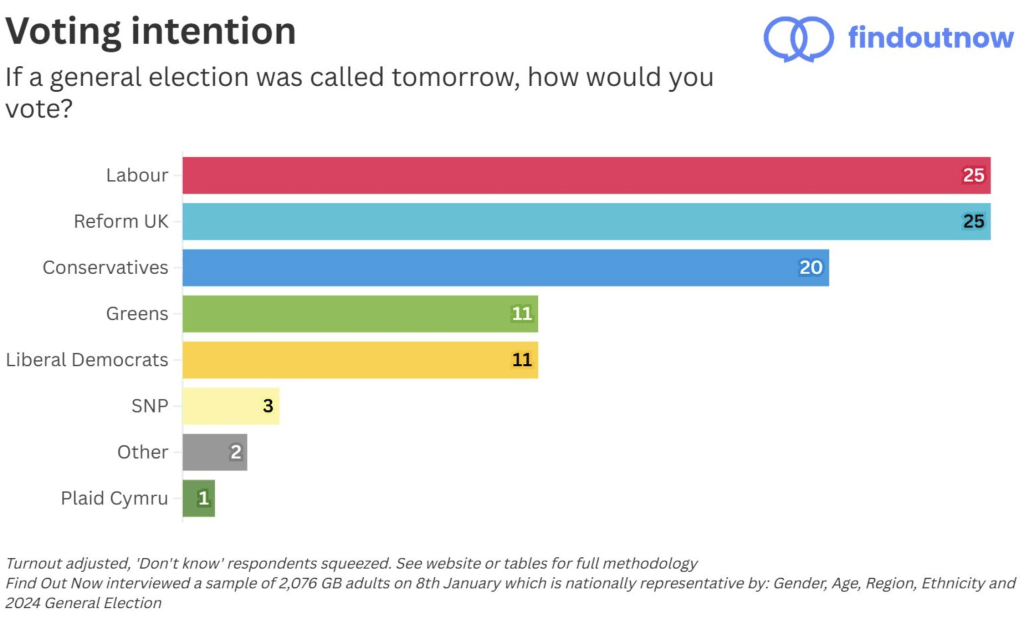

As predicted on this blog.

Labour hated, “Conservatives” (under a silly and useless Nigerian woman carpetbagger) despised, LibDems a dustbin for uncertain votes, or a non-choice. Result— Reform UK, though underwhelming, as a straw at which to clutch, and at the same time a serious protest vote.

According to Electoral Calculus, that, at a General Election, would make Reform UK the official Opposition: Labour 269 Commons seats, Reform 149, Conservatives 101, LibDems 73, Greens 6. https://www.electoralcalculus.co.uk/userpoll.html.

The most likely outcome there would of course be a Lab/LibDem coalition, or maybe a Lab minority govt. with LibDem support. If either of those, then there might be a LibDem demand for proportional representation, to replace the current ridiculous First-Past-The-Post voting system.

Incidentally, such a voting result would also mean that about 143 Labour MPs would be culled, and another 20 Con Party MPs would also lose their seats.

Also incidentally, if that result were to be changed in only one small aspect, Reform UK going up from 25% to 26% (with all other vote shares unchanged), the end result would be Lab 259, Reform 173, Con 87, LibDems 73, Green 6. That would be existentially disastrous for the Con Party

More tweets

Looking hopeful…

“Why is Britain going bankrupt and what might this mean? Let’s take a look.

First it is worth noting, Labour et al might calm the markets in the short-term but what markets are telling us is that there is a festering problem – even if this goes away in the coming weeks it will keep coming back.

There are short-term and long-term trends driving the bankruptcy; a few of the long-term trends are poor resource allocation in the public sector, aging population and low growth; short-term trends are basically COVID-19 spending and spending on energy price guarantees due to Ukraine war – also BoE’s enormous losses from QE aren’t helping.

Britain can always print money to finance its debt but the problem is that foreign debt sales keep sterling propped up which, in turn, keeps UK living standards propped up at an artificial level; if sterling were allowed fall to close the large trade deficit and Britons were forced to live within their means, living standards would be lower – probably significantly lower.

If/when the bankruptcy takes place there are basically two paths that it can take: either the government impose harsh austerity, likely by handing the reins to the OBR and the Treasury, or the country is put into receivership and the keys are handed to the IMF.

There is some talk that the IMF option is like what happened in 1976 – yes and no; in 1976 UK government debt was below 50% of GDP and while the country’s trade deficit was large it had only opened two years beforehand; today government debt is well over 100% of GDP and the trade deficit is not only enormous but has been enormous for 20 years (!).

Britain lives beyond its means by managing capital via the City of London; rather than producing goods to export the country tries to attract capital inflows sustain higher levels of consumption than the economy would naturally allow – but a serious crisis will change all this making the situation very different to 1976.

In 1976 the UK was really just trying to stabilise sterling amidst some troublesome worldwide inflationary pressures while today the country needs to be treated like the typical patient that the IMF gets its hands on.

Nor would such an austerity program even look like, say, Ireland after 2011 which was aimed at bringing down wage costs and making the country competitive again – this meant that the country went through a few years of pain and recession but then emerged with their living standards intact and started growing once more.

Rather any austerity program that is applied by Britain – whether by the IMF or by OBR-Treasury, or some combination of the three – would look more like what happened to Greece after 2011: a managed, permanent decline in living standards.“

Is there a silver lining? There would be, if all the above led to a real social-national government and “a revaluation of all values“…

Talking point

More tweets seen

That tweeter is easily brainwashed, it seems. Never saw his tweets previously. They seem pretty silly, pretty unthinking.

Ah, just noticed that the tweeter works for Private Eye. What a co-incidence…

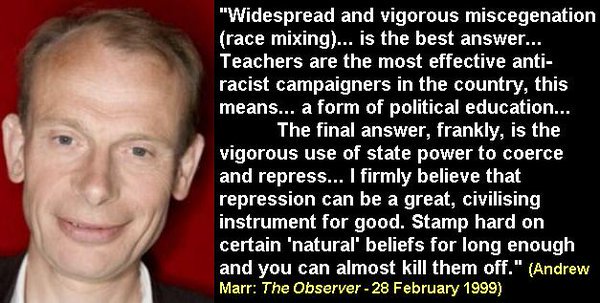

System drones Ian Hislop and Andrew Marr attack Elon Musk. There is an agenda here, as in “the public should trust the System mass media“.

Hislop, together with his totally unfunny pseudo-satire Have I Got News For You cabal, is to our society what the supposedly funny, supposedly satirical, Krokodil magazine was to Soviet society. Meaning— approved “satire” by approved “satirists” attacking “safe” targets.

https://en.wikipedia.org/wiki/Krokodil.

(cf. Paul Merton. Again, unfunny and pointless). https://en.wikipedia.org/wiki/Paul_Merton.

Hislop has made a good thing for himself (and his bank balance) out of attacking “the right” targets. The same or similar might be said of Marr. Look at how they think, or want the public to think, that the mainstream media can be trusted. It could be called stupid to think like that, but Hislop knows exactly what he is doing.

As for Marr, a disgraceful System-approved journalist. His views? See below:

https://en.wikipedia.org/wiki/Andrew_Marr

https://en.wikipedia.org/wiki/Ian_Hislop.

Marr and Hislop might be characterized by the cartoon below:

Late tweets

Out with him. First boat out.

I wonder what the UK figure is?

Late music